Although SEO may not be the number one priority for many CBD companies, digital, in general, is. Data from the Brightfield Group shows that almost 40% of all CBD sales are e-commerce, and that e-commerce is roughly two times as large a channel as pharmacy and three times as large a channel as CBD specialty retailers.

So recently I decided to figure out where the top 10 CBD companies get their organic traffic to inform the strategies we use for clients (and we’re sharing this so you can use it for your brand, too).

I also wanted to dive a bit deeper into how they’re using SEO-focused content to drive organic growth.

We have a client in the CBD space, and in building and executing their CBD content marketing strategy we’ve noticed that this space is fairly uncompetitive. There isn’t a lot of good content, even on very valuable topics.

Blogging isn’t the first priority in e-commerce, as category and product pages will always convert higher than blog posts.

And, as I’ll discuss in the conclusion, in many industries, there simply isn’t much to write about that potential customers would be looking for.

But this is not the case in the hemp and CBD industry — there is a lot to read about, so investing in content is worth it.

So I wanted to see whether this lack of competition was an isolated thing, or if the major players in the CBD space are ignoring SEO-focused content. And if they are, what SEO efforts are they investing in?

This is why I decided to look in-depth at top CBD companies’ content marketing efforts, in addition to generally looking at their SEO.

How I Did This Analysis

I found publicly available data on the top 10 CBD companies by market share, then I used SEMrush, an SEO tool, as well as my independent observations of these companies’ sites, to analyze their organic traffic sources.

As you’ll see a moment, my data on the top CBD companies is stale (Q2 2022). I didn’t want to have to subscribe to ZoomInfo a similar platform just for this analysis, and this is the latest free data I could find.

CBD and hemp is a nascent and fast-moving industry. Many things have happened since Q2 2022 — for instance, Green Roads went bankrupt and was sold to Global Widget by The Valens Company, which had previously acquired it.

Still, these companies are currently business, and they are all still among the largest CBD companies as of the time of writing (Q4 2023).

They can provide an accurate representation of how the major players go about acquiring customers online — for our purposes, this list works.

According to Statista, the top 10 CBD companies in the US by market share are, as of Q2 2022:

- Charlotte’s Web — 2.27%

- Your CBD Store (Sunmed) — 1.88%

- Medterra — 1.72%

- CBD American Shaman — 1.26%

- CbdMD — 0.95%

- JustCBD (Flora Growth) — 0.89%

- Social CBD (Kadenwood) — 0.85%

- Lazarus Naturals — 0.81%

- Hemp Bombs (Global Widget) — 0.79%

- Green Roads (Global Widget) — 0.79%

I will be excluding Sunmed and CBD American Shaman here, as both of these companies are primarily brick-and-mortar franchises:

- E-commerce isn’t their first priority anyway

- There are many websites for each business, as different franchises set up their own sites — this makes total SEO footprint hard to measure, and it’s even harder to determine the value of this combined visibility compared to other channels

So, due to their business model, Sunmed and CBD American Shaman are out of the race.

However, to keep the sample size sufficient, I added in two other major CBD companies: Cornbread Hemp and Plus CBD (CV Sciences’ flagship CBD brand).

Now that my (many) qualifiers are out of the way, let’s keep moving.

Where Do Top CBD Companies Get Their Organic Traffic?

The first order of business was determining where these 10 companies get their organic traffic.

Note that I only care about organic traffic — stuff that comes from search engines like Google and Bing — not direct traffic or visits from social media or other sites.

I split organic traffic into three buckets:

- Branded Traffic — Traffic from people searching a brand’s name or for a brand’s products. This type of traffic is more reflective of a company’s success with PR and retention marketing than it is with acquisition-focused SEO efforts, however, I’m still including it because it tells us about a brand’s marketing priorities.

- Product Traffic — Traffic to category and/or product pages, typically from searches for specific types of products, or for a specific product (e.g. “CBD gummies” “CBG capsules” “500mg CBD tincture”). In doing this analysis, I assumed product traffic to be whatever traffic was left over after I subtracted branded and blog traffic, which were far easier to calculate accurately. As such, my product traffic numbers are a little more off than my other numbers.

- Blog Traffic — Traffic to blog posts or other education-focused pages that were not product categories or products. I excluded traffic to blogs from branded terms (e.g. a blog post titled “How To Take [X Brand’s] CBD Oil”), as I wanted to focus on the use of the blogs as a tool for acquiring new customers, rather than nurturing existing customers.

What I Did

Note: SEMrush, as with every other SEO tool, is not completely accurate, as it relies on 3rd-party keyword and traffic data. Still, it gives us a good idea of where these companies get their traffic.

With my desired data in mind, I put the domains of the 10 companies into SEMrush, and then used various reports to uncover which types of search terms were driving traffic (or which URLs were receiving traffic).

I recorded the total traffic, branded traffic, product traffic, and blog traffic for each company, then put it into a chart:

The very top of each company’s bar represents their total organic traffic according to SEMrush. The differently colored smaller bars that make up each company’s bar, per the legend, show the proportions of branded (blue), product (red), and blog (yellow) traffic.

Takeaways

Investing in building a brand is just as important as investing in more “pragmatic” customer acquisition channels, or at least should be prioritized in the course of building these channels

Data: Branded queries are the #1 organic traffic source for 7/10 brands analyzed.

While SEO can go a long way in driving traffic from potential buyers throughout the funnel — to both transactional and informational pages — investing time into building your company’s brand is crucial. This data shows it firsthand — if you want to be a major player, you’re going to need to build a brand and turn customers into loyal customers.

In e-commerce, people buy with their heart, then their head. Nail down your brand before trying to scale with SEO, ads, or any other channel.

Content marketing is a relatively untapped SEO opportunity for CBD brands

Data: Only 4/10 companies are driving over 1,000 sessions per month with their blog, and 3/10 are driving less than 100 sessions from their blog.

SEO-focused content marketing hasn’t seen the near-ubiquitous embrace in the CBD space that it has in many other industries.

As I discussed a bit in the intro and will discuss a lot more later, in many e-commerce industries, it makes sense not to focus much on blogging. This isn’t the case in the CBD and hemp space, where trust is key and the road to trust is educating people.

This data is good news for brands like yours: there’s plenty of relatively easy traffic (some of it very monetarily valuable) that brands with more resources aren’t going after.

Not all companies appear to have significantly invested in SEO of any kind

Data: 4/10 companies have very small amounts of product traffic in relation to the size of their branded traffic

Considering the amount of money that each of these companies makes, it would seem logical that they’d invest in SEO to make even more. In the course of my exploration, it was clear that most of these brands had been doing some SEO, but other brands seem to have a lot of opportunity they aren’t capitalizing on.

And I’m not just talking about blogging, which is the third most important SEO activity for e-commerce brands. I’m talking about optimizing product and category pages.

Lazarus Naturals, a well-known and well-loved CBD brand, gets over 37,000 sessions from branded traffic each month but just 4,100 sessions from product-related queries. With more optimization, they could be acquiring many, many (!!!!) more customers from organic search.

Other examples of SEO under-optimization include Green Roads, JustCBD, and Medterra.

I’m not saying it’s necessarily the right move for them, or that they haven’t considered it (I can guarantee you they have), but I am pointing out that the lack of SEO action from big brands has created a massive opportunity for smaller brands to rank for valuable product-related queries.

Something funny: people can’t spell “Lazarus Naturals”

To figure out how much branded traffic Lazarus Naturals gets, I had to filter by specific keywords (those with the brand name in them).

Needless to say, there are many variations of the word “Lazarus” to account for:

One moment, I need to go place my order at Lazareth Naturals. 😅

(Jokes aside, though, this underscores the importance of accounting for misspellings when doing keyword research and building an SEO strategy.)

The Data: How Are Top CBD Companies Using SEO-Focused Content to Get Traffic?

Although most of the CBD brands I analyzed either aren’t using blogging or are only using it a little bit (and with limited success), I still wanted to analyze the SEO-focused content efforts of the brands that were.

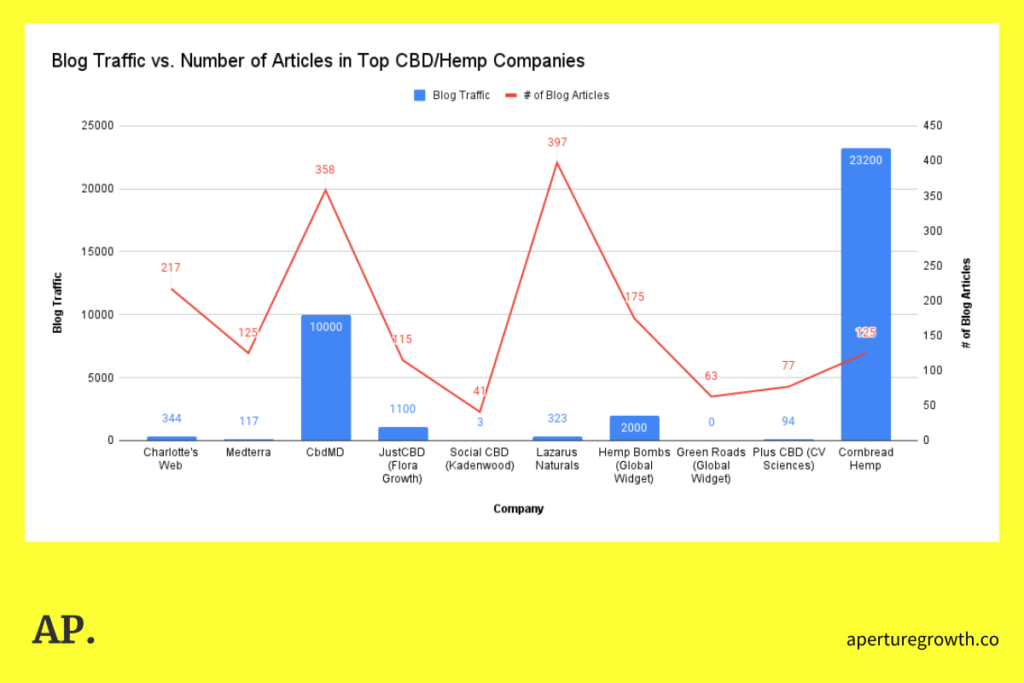

Here, I wanted to look at two data points: the amount of blog traffic each company has (via my previous analysis) and the number of articles on their site.

This will give you an idea of how many articles you’ll need to write before you begin seeing results.

It will also give you an idea of how well your competitors are doing with their content — if they have lots of articles and little traffic, their content probably isn’t very good, because most of it isn’t performing. The opposite is true if their blog traffic is disproportionately high for the number of articles they’ve published.

However, don’t completely take these numbers to the bank. Keep in mind:

- The number of articles is much less important than the quality of the articles. All sites will need to blog a certain amount before beginning to see rankings (you have to build up some site authority), but once you’re discovered, you don’t need to worry as much about how many articles you’re putting out as you do about the quality of them. Quality (and periodic updates) ensures you maintain the growth you achieve.

- These companies probably have more authority than you. Authority is a concept that describes how reputable and authoritative a site appears in the eyes of Google. Authority is not an official metric, but it’s influenced by things like the number of backlinks you have, the amount of direct traffic and branded traffic you receive, and the amount of content you’ve published about certain topics. Google wants to serve content from reputable websites; the more authority your site has, the better. Because the brands in this analysis are all well-known brands with lots of authority signals, they will rank more quickly (and at least in the beginning, rank better) than you if you produce the same content. You’ll start a bit behind the curve, but you can make up for it over time as you gain visibility and authority yourself.

What I Did

For this analysis, I went through each company’s blog to see how many articles they’ve written. I excluded any posts that were news-oriented, rather than educational, if they were in a section separate from the SEO-focused content.

I then combined this data with the blog traffic data from my previous analysis to make the following chart:

Takeaways

And here’s what we can learn from this chart.

Many large CBD companies aren’t leveraging content marketing

Data: 6/10 companies get less than 1,000 sessions per month through their blog

Of all the data points on this chart, this one spells out the overarching reality: lots of CBD companies are not leveraging content-based SEO.

Some are leveraging other forms of SEO; for instance, Charlotte’s Web, which gets just 300-400 sessions from their blog each month, is ranking for quite a few lucrative product-based terms.

However, content-driven SEO is largely ignored, making it a relatively easy opportunity for smaller brands with fewer resources.

Data: 10/10 companies have published 40+ articles, but only 4/10 get 1,000+ sessions per month through their blog

Some companies, all of which have strong domains, like Social CBD, Medterra, Charlotte’s Web, and especially Lazarus Naturals, seem to have written a significant amount of blog content, but they aren’t receiving much organic traffic through it.

Even Social CBD, with 41 well-written, SEO-optimized articles, could be pulling in several thousand visitors per month through their blog.

The reason for this is that much of this content seems to be written for sharing on social media, rather than ranking for search queries. This strategy has some value, and I can understand why companies do this.

Personally, I think brands should diversify their content efforts: produce content that ranks, but also produce content that stops the scroll on social media (you can do both at once, but it works better if you give each piece of content its own purpose).

You’ll need to produce content weekly for a few months, minimum, to see results

Data: all brands with over 1,000 monthly blog traffic have written 100+ articles.

This data point is more a suggestion than gospel because I can tell you upfront that you do NOT need 100 articles to get a lot of traffic from Google.

We have clients pulling in 15,000+ monthly sessions with their blog from less — and it converts, too.

Where I will get preachy is that you’ll need to write at least 15-20 articles for the Google Gods to start noticing you. But don’t rush to this number — instead, focus on making each article as useful and delightful to read as possible, while also optimizing for SEO.

This will ensure that once each article ranks, it will continue to rank (with routine maintenance), and will gradually rank for more and more keywords as you work on more articles — this will enable compounding to take over, and six months later, you’ll be swimming in traffic.

And if you’re writing about the right topics, you’ll be swimming in revenue, too.

Why SEO-Focused Content Marketing is Valuable for CBD Brands

As we’ve learned today, blogging isn’t the first priority for many companies in the CBD industry.

In fact, it’s not a priority in many e-commerce SEO industries. Since most consumer products don’t require a lot of research before reaching a buying decision, the value of blogging for brands is somewhat diminished, except for very bottom-of-funnel queries.

Content marketing agency Grow and Convert came up with one way to visualize this by placing every industry on a readability index:

- If consumers want to research products in a specific vertical in-depth before purchasing them and if there’s a lot to discuss, then an industry has a high readability index.

- If there’s little to discuss, and little that people want to know, the industry has a low readability index.

But the CBD space differs from many other e-commerce verticals on the readability index. There’s a lot that people want to know. They want to know about the different cannabinoids in hemp, what the benefits (and detriments) of these products are, and how to use these products to improve their quality of life.

The CBD space is still fairly new. There’s still a lot we don’t know about how cannabis products work, there’s still a lot of research that needs to be done, there are still grey areas around the legality of some products, and there is a lack of government regulation, so there are many low-quality products on the market.

And yet, the experiences of millions of people show that these products are hugely beneficial — so there’s a massive desire to learn more:

- There’s a lot people want to know

- If you can give people straightforward, no-BS information, you can build trust credibility with them

- If they trust you, they’ll be more likely to buy from you

Because of this, I think content marketing is a better opportunity in the CBD vertical than in most other e-commerce verticals. And it’s one that many brands are missing out on big time.

Conclusion

This analysis revealed two major things: not all large CBD brands are using an all-cylinders SEO strategy, and for those who are, over half aren’t seeing any success (due to a lack of investment, I presume) on the content side of things.

Granted, some of these brands don’t necessarily need to do content SEO, and some are even doing just fine without any significant SEO investment. They build a brand, and now that brand carries them. While this is a lesson for any new CBD brand, it’s also true that smaller brands need a way to get to the next level.

Don’t make the mistake of trying to replicate what the big companies are doing when you’re not yet a big company: do what will move the needle for your company.

I’d argue that while SEO isn’t the only channel toward acquiring customers, and it takes 6 months or so to really begin working, it is a viable route to take — especially since search isn’t very competitive in the CBD industry, and paid ads are off the table (at least, until you’re getting enough sales and traffic to buy them profitably and escape the ad platform policies against CBD — that’s another topic for another day).

There are literally topics you can write about that no other CBD company has. I know because I see them every day. And if you rank for these terms, you’ll get sales and email signups. Sales are wonderful, and the email signups will turn into sales if you already have email marketing in place (I’d recommend setting up email marketing flows for new subscribers before you EVER start doing SEO).

If there’s a takeaway here, it’s that SEO is a viable customer acquisition channel for CBD companies, and some of the big guys aren’t even doing it. And the content side of SEO allows you to go for the customers that other brands aren’t.

Dominate, don’t compete.

I hope you found this analysis and discussion valuable. Questions, comments, complaints, concerns? Leave a comment below, send me an email: (wells [at] aperture [dot] co), or find me on X (formerly Twitter. lamest switch-up ever.)